Crucial Steps for Successfully Qualifying for Financial Assistance as a Low-Income Individual

Understanding the process of qualifying under a low income classification is essential for individuals and families who are actively seeking support from various assistance programs specifically designed for those facing financial hardships. The definition of low income can vary widely based on several factors, including geographic location, household composition, and the prevailing local economic environment. Generally, low-income thresholds are determined by federal, state, or local governments, which directly impact eligibility for numerous assistance programs that aim to provide critical support to those in need. Familiarizing yourself with these thresholds is the first crucial step in determining your eligibility and effectively accessing the resources available to you.

Comprehending Local Income Thresholds to Qualify for Various Assistance Programs

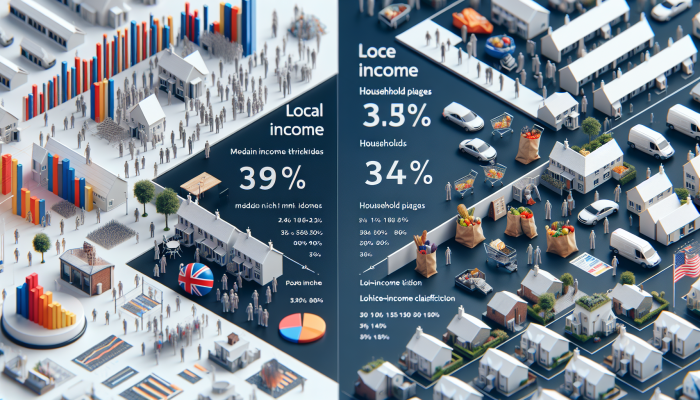

To effectively navigate the intricate landscape of low-income qualifications, it is imperative to understand the specific income thresholds that apply to your locality. For example, in the UK, the government typically defines “low income” as any income that falls below 60% of the regional median, categorizing these individuals as low-income earners. These figures can differ significantly based on household dynamics and regional economic conditions. In contrast, the United States Department of Housing and Urban Development (HUD) sets low-income guidelines based on the area’s median income (AMI). Familiarizing yourself with these thresholds not only helps in assessing your financial status but also greatly improves your ability to effectively access available resources.

Moreover, it is crucial to recognize that income thresholds can vary dramatically from one region to another. For instance, residing in London may present a higher threshold compared to more rural areas. Therefore, conducting comprehensive research on local resources and consulting official government websites for the most accurate and relevant information regarding income thresholds is essential. This diligent research empowers you to determine your eligibility for various assistance programs and confidently advocate for your rights in accessing support.

Recognizing the Key Eligibility Requirements for Assistance Programs

The criteria for achieving low-income status often encompass a wide range of factors beyond just income levels. These criteria may include family size, citizenship status, and additional financial considerations. Many government assistance programs require applicants to provide proof of their income along with detailed information regarding any assets they may possess, such as bank account balances, property ownership, and various financial investments.

Furthermore, certain programs may impose specific requirements related to employment status. For instance, individuals who are unemployed or underemployed might qualify for different types of assistance compared to those who are employed yet still meet the low-income threshold. Additionally, some programs may prioritize vulnerable groups, including single parents, seniors, or individuals living with disabilities, thus highlighting the importance of understanding these criteria.

Grasping these eligibility requirements is crucial for effectively navigating the assistance landscape. By familiarizing yourself with the specific requirements, you can prepare your application with the necessary documentation and information that substantiates your low-income status. This level of preparation not only increases your chances of qualifying for the support you need but also streamlines the application process, making it less daunting.

Gathering Essential Documentation to Confirm Low-Income Status

When it comes to validating your low-income status, having the appropriate documentation is paramount. Assistance programs typically require a variety of documents to substantiate your income and living conditions. This usually includes recent pay stubs, tax returns, bank statements, and proof of any government assistance you may currently be receiving, all of which serve to confirm your financial situation.

In addition to income documentation, you may also need to provide evidence regarding your household composition. This could involve submitting documents that verify the number of individuals residing in your household, such as birth certificates for children or proof of residency for other family members, which helps illustrate your need for assistance.

Keeping your documents organized and easily accessible is crucial, especially since the application process for assistance can often be time-sensitive. By gathering the required paperwork in advance, you can streamline your application process and reduce the likelihood of delays or rejections. Furthermore, being well-prepared signals to the reviewing body that you are serious about obtaining assistance and that you meet the necessary criteria, enhancing your chances of success.

Your Comprehensive Resource for Government Assistance Programs Targeted at Low-Income Families

Acquiring a comprehensive understanding of the various government assistance programs available for low-income individuals and families is critical for those in search of financial support. These programs serve a fundamental role in providing essential resources in critical areas such as housing, food, and healthcare, thereby significantly improving the overall quality of life for beneficiaries and helping them regain stability.

Exploring Housing Benefits Designed for Low-Income Individuals

Applying for housing assistance often represents a pivotal step for individuals and families experiencing low incomes. In the UK, the housing benefit system is specifically designed to assist individuals on low incomes in managing their rental costs effectively. Understanding the application process, along with the criteria used to determine eligibility, is essential for achieving success in accessing these benefits.

To qualify for housing benefits, applicants typically need to demonstrate that they are receiving a qualifying benefit or that they are classified as having a low income. This often necessitates the submission of income documentation and proof of residency, which helps establish the need for assistance. The amount of financial assistance you may receive will depend on various factors, including your income, household size, and the current local housing market rates.

Navigating the application process can be daunting; however, local councils and housing associations frequently provide resources and support to assist you. Many also offer online tools to help estimate potential benefits, simplifying the understanding of your eligibility for assistance. Additionally, participating in local workshops or clinics can provide valuable insights and address any questions or concerns you may have regarding the application process.

Accessing Essential Food Assistance Programs for Nutritional Support

Food assistance programs, such as food stamps and food banks, serve as essential resources for low-income individuals and families. These programs are specifically designed to alleviate food insecurity by granting access to nutritious food. In the UK, various food assistance initiatives, such as the Department for Work and Pensions’ Healthy Start scheme, specifically support low-income families with young children, ensuring they have access to the nutrition they need.

To qualify for food assistance, applicants must present proof of income and demonstrate their financial need. Numerous local charities and non-profit organizations operate food banks that distribute food parcels to those in need. These food banks often establish their own eligibility criteria, which may require a referral from a social worker or healthcare professional; however, they primarily aim to assist anyone struggling with food insecurity and the challenges it brings.

Moreover, community initiatives frequently offer supplementary support, including cooking classes or nutrition education, empowering individuals to make informed food choices. Engaging with these resources can help you manage your food budget more effectively while enhancing your overall well-being and health.

Investigating Healthcare Subsidies Available for Low-Income Individuals

Access to affordable healthcare is a fundamental necessity for individuals with low incomes. Various healthcare subsidies and programs are designed to assist low-income individuals in obtaining essential medical care. In the UK, the National Health Service (NHS) offers free services at the point of use; however, some individuals may still incur costs associated with prescriptions, dental care, or optical services, which can be burdensome.

To qualify for healthcare subsidies, you may need to demonstrate your income level. In specific cases, individuals receiving certain benefits might automatically qualify for reduced-cost prescriptions or dental care, easing their financial load. Staying informed about the different types of assistance available is vital, as eligibility can vary based on your specific circumstances and needs.

Additionally, non-profit organizations often provide health services at reduced rates or even free of charge. These organizations typically cater to low-income populations and offer a range of services from general medical care to mental health support. Knowing where to find these resources can significantly enhance your access to essential healthcare and promote your overall health and well-being.

Unlocking Educational Opportunities Designed for Low-Income Individuals

Education serves as a powerful tool for breaking the cycle of poverty, and numerous opportunities are available for low-income individuals seeking to enhance their educational qualifications and skill sets. These opportunities can be essential for personal and professional growth.

Discovering Scholarships and Grants Tailored Specifically for Low-Income Students

Scholarships and grants specifically designed for low-income students can significantly alleviate the financial burden associated with education. Many colleges and universities offer scholarships based on financial need, merit, or a combination of both. It is crucial to conduct thorough research and apply for these scholarships, as they can cover not only tuition fees but also additional costs such as books and supplies, which can add up quickly.

In addition to institutional scholarships, numerous organizations and foundations provide grants for low-income students. These grants typically do not require repayment, making them invaluable for those pursuing higher education without accumulating debt. Exploring scholarship databases and dedicated websites is essential to uncover opportunities tailored to your unique circumstances, ensuring you have access to the support needed to pursue your educational goals.

Networking with academic advisors or financial aid officers can also reveal lesser-known scholarships and grants that may be available. By actively seeking out these resources, you can maximize your chances of securing the financial support necessary to pursue your educational ambitions and achieve your career goals.

Utilizing Tuition Assistance Programs for Financial Relief in Education

Tuition assistance programs represent another avenue of support for low-income individuals seeking education. Many community colleges and vocational schools offer financial aid based on demonstrated financial need. These programs often include reduced tuition rates, flexible payment plans, or grants that can alleviate the financial burden associated with pursuing education or vocational training.

To qualify for tuition assistance, applicants typically need to complete a Free Application for Federal Student Aid (FAFSA) or its equivalent, depending on the country. This form assesses financial need and determines eligibility for various types of financial aid, making it a crucial step in accessing support. Accurately and promptly completing your application is key to maximizing your opportunities for assistance.

Additionally, some organizations and employers provide tuition reimbursement programs, which can further help offset educational costs. Investigating all available options and applying early can significantly enhance your ability to access tuition assistance and make your educational aspirations more achievable.

Exploring Student Loan Forgiveness Opportunities for Financial Relief

Student loan debt can pose a significant burden for many low-income graduates, making it essential to explore available relief options. Fortunately, various loan forgiveness programs exist to assist those who meet specific criteria. In the UK, student loans are often forgiven after a certain period, particularly for individuals earning below a defined income threshold, allowing them to move forward without the weight of debt.

In the United States, numerous federal student loan forgiveness programs, including Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, cater specifically to low-income individuals. These programs often require borrowers to work in qualifying fields or serve in specific capacities for a predetermined duration, making it essential to understand the requirements for loan forgiveness to effectively manage your education debt.

Keeping meticulous records and ensuring that you meet all necessary criteria can pave the way for loan forgiveness, alleviating financial stress and allowing you to concentrate on your career and personal development. Understanding these opportunities is crucial for long-term financial health and success.

Employment and Training: Empowering Your Career Growth and Stability

Obtaining stable employment is a fundamental component of improving one’s financial situation. Various programs and resources exist to assist low-income individuals in acquiring the skills and experience necessary for career advancement, helping them achieve their professional goals.

Investigating Job Training Programs for Career Development

Many organizations provide free or low-cost job training programs aimed at helping individuals acquire marketable skills. These programs often target high-demand industries, such as healthcare, technology, or skilled trades, equipping participants with the qualifications necessary to secure stable employment and improve their financial circumstances.

To qualify for these training programs, applicants may need to demonstrate financial need and provide documentation regarding their current employment status. Many training programs also offer supplementary support services, such as resume workshops and interview preparation, which further enhance employability and increase the chances of securing a good job.

Participating in job training can create pathways to better job opportunities and higher wages, ultimately assisting individuals in lifting themselves out of low-income situations. Furthermore, networking with program coordinators and fellow participants can lead to invaluable connections within your chosen industry, opening doors to future opportunities.

Taking Advantage of Apprenticeship Programs for Hands-On Experience

Apprenticeships present a unique opportunity to earn while you learn, making them an appealing option for low-income individuals. These programs blend on-the-job training with classroom instruction, allowing participants to gain practical experience while receiving a wage, helping them build a professional skill set.

To secure an apprenticeship, it is essential to research local opportunities and industries that offer such programs. Various trade unions and professional organizations actively promote apprenticeship schemes, which can provide a structured pathway to a successful career in fields where skilled labor is in demand.

Moreover, completing an apprenticeship often leads to permanent employment. By leveraging these opportunities, low-income individuals can build sustainable careers while avoiding the student debt commonly associated with traditional educational pathways, thus achieving financial independence over time.

Accessing Employment Support Services for Job Seekers

A multitude of support services are available for low-income job seekers, ranging from job placement assistance to career counseling. Numerous non-profit organizations and government agencies provide resources to help individuals secure stable employment, which is crucial for achieving financial stability.

These services often encompass resume writing workshops, interview coaching, and job search assistance, equipping job seekers with the necessary tools to navigate the competitive job market effectively. Additionally, certain programs may offer follow-up services to ensure ongoing support after securing employment, helping individuals to adapt and thrive in their new roles.

Utilizing these resources can significantly enhance your chances of finding suitable employment while providing the encouragement and support needed to overcome challenges associated with low-income job searching, fostering a path toward self-sufficiency.

Strategic Financial Management for Low-Income Households: Building Stability

Effective financial management is crucial for low-income households to maximize their limited resources. By implementing sound financial practices, individuals and families can enhance their financial stability and work toward long-term financial goals, ultimately leading to improved life outcomes.

Implementing Practical Budgeting Strategies for Low-Income Individuals

Establishing a budget is essential for low-income individuals striving to manage their finances effectively. A well-structured budget enables you to track your income and expenses, identify areas for cost savings, and allocate funds toward essential needs like housing, food, and transportation.

Start by listing all sources of income, followed by a detailed account of monthly expenses, which may include rent, utilities, groceries, and transportation costs. Once you have a comprehensive overview of your financial situation, you can prioritize necessary expenses and identify discretionary spending that can be minimized or eliminated.

Utilizing budgeting apps or tools can simplify the process, making it easier to manage your finances effectively. Regularly reviewing and adjusting your budget can help you maintain accountability and adapt to any changes in your financial circumstances, ensuring you remain on track toward your financial goals.

Effective Strategies for Reducing Debt Burdens

Managing debt can be particularly challenging for low-income individuals, but various strategies can help alleviate this burden. First, it is essential to prioritize debts based on interest rates and payment deadlines. Focus on paying off high-interest debts first, as these can accumulate quickly and hinder your ability to manage other essential expenses.

Additionally, consider reaching out to creditors to discuss payment plans or potential settlements. Many lenders are willing to work with individuals facing financial difficulties, and negotiating lower payments can ease the strain on your budget while helping you regain control over your financial situation.

Exploring options for consolidating debts or seeking assistance from credit counseling services can also prove beneficial. These resources can offer valuable advice on effective debt management and help you develop a sustainable plan to achieve financial stability, allowing you to focus on building a secure future.

Adopting Practical Saving Techniques for Low-Income Households

Saving money on a low income might seem overwhelming, but it is achievable with the right strategies. Start by setting realistic savings goals, even if they are modest. Establishing a separate savings account can help you resist the temptation to dip into your savings for daily expenses, fostering a habit of saving over time.

Consider employing the “pay yourself first” approach by allocating a portion of your income to savings before addressing other expenses. This method can help cultivate a savings habit, gradually increasing your financial cushion for emergencies or future investments, ultimately enhancing your financial resilience.

Furthermore, explore community resources that may offer matching savings programs or incentives for low-income individuals. These initiatives can significantly enhance your savings efforts and support your journey toward a more secure financial future, enabling you to build wealth over time.

Leveraging Community Resources for Low-Income Support and Empowerment

Community resources play a vital role in assisting low-income individuals and families, providing various services and support to help them navigate financial challenges. Engaging with these resources can empower individuals to access the assistance they need.

The Essential Role of Food Banks and Pantries in Alleviating Hunger

Food banks and pantries serve as essential lifelines for individuals and families facing food insecurity. These community resources offer free groceries and meals to those in need, helping alleviate hunger and ensuring families have access to nutritious food that is crucial for their well-being.

To access food bank services, individuals typically need to present proof of income, residency, and any required identification. Many food banks operate on a no-questions-asked basis, ensuring that assistance is available to anyone in need, regardless of their background or circumstances.

In addition to food distribution, some food banks provide supplementary services, such as nutrition education, cooking classes, and meal planning workshops. Engaging with these resources empowers individuals to make healthier food choices and maximize their grocery budgets, promoting better health and nutrition.

Support from Charitable and Non-Profit Organizations for Financial Relief

A multitude of charitable and non-profit organizations are dedicated to supporting low-income individuals and families. These organizations offer a wide range of services, including financial assistance, job training, and educational resources, all aimed at alleviating financial burdens and improving quality of life.

To access these resources, it is crucial to conduct thorough research on local charities and non-profits in your area. Many organizations have specific programs tailored to assist low-income populations, and their services can greatly ease financial burdens, providing individuals and families with the support they require.

Volunteering with these organizations can also create valuable networking opportunities and provide a chance to give back to the community. Building connections within these networks may lead to additional support and resources to aid you on your journey toward financial stability and empowerment.

Community Centers as Essential Hubs for Local Support Services

Community centers often serve as critical hubs for local support services, offering a variety of resources and programs for low-income families. These centers may provide access to food assistance, childcare services, healthcare resources, and educational workshops, all aimed at improving the well-being of community members and fostering social connections.

Community centers frequently host events and activities designed to foster social connections and community engagement. Participating in these events can provide a sense of belonging and support, which is particularly beneficial for individuals facing financial hardships and seeking to improve their circumstances.

Exploring the services offered by your local community center can reveal valuable resources that may assist you in effectively navigating your low-income situation and connecting with others who share similar experiences.

Empowering Yourself: Understanding Your Rights with Legal Aid

Being aware of your legal rights is essential for low-income individuals, as it empowers you to advocate for yourself and access the necessary support to navigate complex systems.

Accessing Free Legal Services for Low-Income Individuals

Free legal services are available to assist low-income individuals with a variety of legal issues, including housing disputes, family law matters, and consumer protection. Many organizations offer pro bono services, providing legal representation and guidance to those unable to afford a lawyer, ensuring that everyone has access to justice.

To access these services, individuals must demonstrate financial need and submit relevant documentation. Researching local legal aid organizations can help you find the support you need in addressing legal challenges that may arise.

Numerous community centers and non-profit organizations also offer legal clinics or workshops, providing valuable information on navigating common legal challenges. Engaging with these resources can empower you to understand your rights and seek assistance in resolving legal issues effectively, ensuring you are adequately protected.

Understanding Tenant Rights for Low-Income Renters

Understanding tenant rights is crucial for low-income individuals renting their homes. Tenants possess specific rights concerning housing conditions, eviction processes, and rent increases, which are designed to protect them from unfair treatment. Familiarity with these rights enables you to advocate for yourself and ensure that your landlord complies with their legal obligations, contributing to a more stable living situation.

If you encounter issues with your landlord or housing conditions, seeking assistance from local tenant advocacy organizations can be invaluable. These organizations frequently offer resources, guidance, and legal representation to help tenants navigate disputes effectively, ensuring that your rights are upheld.

Being informed about your rights as a tenant not only protects you but can also enhance your overall housing stability, making it easier to concentrate on other vital aspects of your life and work toward improving your situation.

Consumer Protection for Low-Income Individuals Against Exploitation

Low-income individuals can often be vulnerable to financial exploitation, making it imperative to comprehend consumer protection laws. These laws are designed to safeguard consumers from unfair or deceptive practices and ensure fair treatment in financial transactions, promoting a more equitable marketplace.

If you believe you have fallen victim to fraud or unfair practices, various resources are available to help you report these issues and seek resolution. Numerous consumer protection agencies provide information about your rights and can assist you in navigating disputes with businesses, ensuring that you are empowered to stand up for yourself.

Staying informed about your consumer rights empowers you to make informed financial decisions and protect yourself from potential exploitation, contributing to your overall financial security and well-being.

Mastering the Low-Income Assistance Application Process for Success

Navigating the application process for assistance can be daunting, but understanding the necessary steps can significantly enhance your chances of success in receiving the support you need.

Accurately Completing Application Forms for Assistance Programs

Filling out application forms accurately and efficiently is crucial when applying for assistance. Most forms require personal information, income details, and documentation to support your claims. Taking the time to thoroughly read the instructions and ensure you provide all the required information can prevent processing delays for your application, enabling a smoother experience.

Consider seeking help from local organizations or community centers that offer application workshops or one-on-one support. These resources can provide valuable guidance on completing forms correctly and help you avoid common mistakes that could jeopardize your application.

Keeping copies of all submitted documents can also assist you in tracking your application and facilitate effective follow-up, ensuring that you remain informed about your application’s status.

Avoiding Common Mistakes During the Application Process

When applying for assistance, it is crucial to be aware of common mistakes that can lead to rejections. One of the most frequent errors is failing to provide complete or accurate information. Always double-check all entries and ensure you provide any requested documentation to support your claims, as missing information can delay processing.

Another prevalent issue is missing deadlines. Many assistance programs operate on strict timelines, and late applications may not be considered. Mark important deadlines on your calendar to help you stay organized and ensure your application is submitted on time, maximizing your chances of receiving assistance.

Seeking feedback from others or utilizing local resources for application support can also help identify potential pitfalls before you submit your forms, giving you a better chance of success.

The Importance of Follow-Up and Appeals in the Application Process

After submitting your application, it is vital to follow up to ensure it is being processed appropriately. Many agencies provide tracking systems or contact information for inquiries, allowing you to check the status of your application and address any potential issues.

If your application is denied, do not be discouraged. Most assistance programs include an appeals process that allows you to contest the decision. Understanding the appeals process and gathering the necessary documentation to support your case can improve your chances of a successful appeal, empowering you to advocate for your needs effectively.

Being proactive in following up on your application and comprehending your options empowers you to navigate the assistance landscape effectively and secure the support you need to improve your situation.

Inspiring Success Stories: Overcoming Challenges of Low Income

Real-life success stories of individuals who have successfully qualified for assistance can provide motivation and practical insights for those facing similar challenges and seeking support.

Case Studies Showcasing Successful Assistance Qualifications

Numerous case studies illustrate the journeys of individuals who have navigated the challenges of qualifying for assistance while on a low income. For instance, one single mother successfully accessed housing benefits, which enabled her to secure stable accommodation for herself and her children. Through diligent budgeting and engagement with local resources, she also managed to reduce her debt and improve her overall financial situation, showcasing the power of resilience.

Another case study features a young graduate who utilized job training programs to enhance her skills and secure stable employment. By leveraging community resources and networking, she successfully transitioned from low-income status to a fulfilling career, demonstrating that opportunities are available for those willing to seek them out.

These narratives serve as essential reminders that, although the path may be challenging, overcoming obstacles and achieving financial stability is indeed possible through determination and resourcefulness.

Valuable Lessons Learned From Success Stories

The lessons gleaned from these success stories reveal essential strategies and practices that others in similar situations can adopt. One significant takeaway is the importance of seeking support from local resources, such as community centers, non-profit organizations, or government agencies, which can provide invaluable assistance and guidance.

Networking and building connections within your community can open doors to new opportunities and provide essential support throughout your journey. Moreover, maintaining a positive mindset and proactively seeking assistance can significantly improve your financial situation, empowering you to take control of your future.

These stories illustrate that resilience, resourcefulness, and determination can lead to successful outcomes, even amid adversity and challenges.

Actionable Tips for Seeking Assistance Effectively

Several actionable tips based on real-life success stories can empower individuals seeking assistance. First, take the initiative to research local resources and programs tailored to low-income individuals. Knowing what is available can significantly enhance your ability to access assistance effectively and improve your situation.

Second, develop a comprehensive plan for managing your finances, including budgeting and tracking your expenses. This will help you gain a better understanding of your financial situation while preparing for future challenges and opportunities.

Finally, do not hesitate to reach out for support. Leveraging available resources, such as connecting with mentors, attending workshops, or accessing legal aid, can provide the guidance and encouragement necessary to navigate your journey successfully and achieve your goals.

Future Trends: Preparing for Changes in Low-Income Support Systems

Staying informed about future trends in low-income support can help individuals and families effectively navigate their financial challenges and access the resources available to them.

Understanding Policy Changes Impacting Low-Income Support Programs

Policy changes can significantly affect low-income support programs. It is essential to remain informed about upcoming legislative changes that may impact eligibility criteria, funding levels, or program availability. Engaging with advocacy organizations or community groups can provide valuable insights into potential changes and how they may affect you and your family.

Additionally, participating in community forums or town hall meetings offers opportunities to voice your concerns and influence policy discussions related to low-income support. Staying engaged in these conversations can help ensure that your needs are represented and addressed.

Technological Innovations Enhancing Access to Assistance

Technological advancements are transforming how individuals access assistance and resources. Many organizations are now utilizing technology to streamline the application process, making it more convenient for low-income individuals to apply for support online. This can eliminate barriers associated with traditional paper applications, thereby increasing accessibility and efficiency.

Moreover, mobile apps and online platforms are emerging to provide real-time information on available resources, assisting individuals in identifying nearby assistance programs. Staying informed about these technological innovations can enhance your ability to access support when needed and improve your overall experience.

Community Initiatives Fostering Holistic Low-Income Support

New community initiatives aimed at supporting low-income families are continually being developed. These initiatives often focus on collaboration between local organizations, businesses, and government agencies to provide comprehensive support services that address multiple needs.

For instance, community-led efforts may include job fairs, financial literacy workshops, or family support programs designed to enhance well-being and stability. Engaging with these initiatives can provide valuable resources and foster connections within your community, enhancing your ability to thrive.

By remaining informed about future trends and actively participating in community initiatives, low-income individuals can more effectively navigate their challenges and work toward building a more stable and prosperous future for themselves and their families.

Frequently Asked Questions Regarding Low-Income Support

What constitutes low income?

Low income generally refers to earnings below a specific threshold compared to the median income in a given region. This threshold can vary based on household size and local economic conditions, impacting eligibility for various assistance programs.

How can I apply for housing benefits?

To apply for housing benefits, complete an application form, provide proof of income and residency, and submit any required documentation to your local council or housing authority, ensuring all necessary information is included.

What food assistance programs are accessible?

Food assistance programs include food banks, food stamps, and local charities that provide grocery support. Eligibility for these programs often requires proof of income and residency, ensuring that assistance reaches those who need it most.

How can I find scholarships specifically for low-income students?

Researching scholarship databases, contacting academic advisors, and exploring local foundations can help you identify scholarships tailored for low-income students, increasing your chances of receiving financial support.

What job training resources can assist low-income individuals?

Many community organizations, non-profits, and government agencies offer free or low-cost job training programs to help low-income individuals acquire marketable skills, enhancing their employability and career prospects.

What budgeting tools can I use to manage my finances effectively?

Various budgeting apps and tools are available to assist individuals in tracking income and expenses, setting savings goals, and managing their finances more effectively, contributing to improved financial stability.

How can I access free legal services?

Free legal services can be accessed through local legal aid organizations, law clinics, and community centers that provide pro bono assistance for low-income individuals, ensuring equitable access to legal support.

What are my rights as a tenant?

As a tenant, you have rights concerning housing conditions, eviction processes, and rent stability. Understanding these rights can help you advocate for yourself in disputes with landlords and maintain housing stability.

How can I reduce my debt while living on a low income?

To reduce debt, prioritize high-interest debts, negotiate payment plans with creditors, and consider seeking advice from credit counseling services for effective debt management strategies tailored to your situation.

What community resources are available for low-income families?

Community resources may include food banks, charity organizations, community centers, and local support services that assist with housing, food, and healthcare, providing critical assistance to those in need.

Connect with us on Facebook!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Low Income Qualifying: Essential Strategies for Success Was Found On https://limitsofstrategy.com